API Reference

You can perform different types of initial payments using our server-to-server REST API.

- Preauthorization

- Capture

- Payment

- Reversal

- Refund

- Inquiry

Common Parameters

Authentication Parameters

The entityId and entityType, Each merchant and institution will have its own entityId, which are included in the request message body (entityId and merchant ID can be the same).

| Required | Format | Description | |

|---|---|---|---|

entityId | Required | AN8[A-Z0-9]8 | The entity required to authorize the request. This should be the channel entity identifier. In case channel dispatching is activated then it should be the merchant entity identifier. |

entityType | Required | AN32 | Entity type of the channel, possible value:MERCHANT POS PARTICIPATOR PARTICIPATOR |

Payment Request Parameters

| Required | Format | Description | |

|---|---|---|---|

card.holder | Optional | A128{3,128} | Holder of the credit card account |

card.number | Optional | N19[0-9]19 | The PAN or account number of the card. If the request contains the card.token field, the card.number and other related information are not required. |

card.expiryMonth | Conditional | N2(0[1-9]|1[0-2]) | The expiry month of the card. |

card.expiryYear | Conditional | N4(19|20)([0-9]{2}) | The expiry year of the card. |

card.cvv | Conditional | N4[0-9]{3,4} | The card security code or CVV |

card.token | Conditional | AN64 | Globally unique identifier for the Token (TUR) |

amount | Conditional | N10.N2[0-9]{1,10}(.[0-9]{2}) | Indicates the amount of the payment request. The dot is used as decimal separator. The amount is the only amount value which is processing relevant. All other amount declarations like taxAmount or shipping.cost are already included. The amount field can be skipped for paymentType=CV |

currency | Conditional | A3[A-Z]{3} | The currency code of the payment request's amount (ISO 4217). |

paymentBrand | Conditional | AN32[a-zA-Z0-9_]{1,32} | The brand specifies the method of payment for the request. This is optional if you want to use brand detection for credit cards, if not then it is mandatory. |

paymentType | Required | A2 | The payment type for the request. You can send payment requests with one of the following types: PA Preauthorization: A stand-alone authorisation that will also trigger optional risk management and validation. A Capture (CP) with reference to the Preauthorisation (PA) will confirm the payment. DB Debit: Debits the account of the end customer and credits the merchant account. CD Credit: Credits the account of the end customer and debits the merchant account. CP Capture: Captures a preauthorized (PA) amount. CV Verification: Card verification RV Reversal: Reverses an already processed Preauthorization (PA), Debit (DB) or Credit (CD) transaction. As a consequence, the end customer will never see any booking on his statement. A Reversal is only possible until a connector specific cut-off time. Some connectors don't support Reversals. RF E-commerce Refund: Credits the account of the end customer with a reference to a prior Debit (DB) or Credit (CD) transaction. The end customer will always see two bookings on his statement. PR POS Refund: Credits the cardholder account with a reference to a prior POS Purchase transaction. |

taxAmount | Conditional | N10.N2[0-9]{1,10}(.[0-9]{2}) | Indicates the tax amount of the payment request. The dot is used as decimal separator. |

descriptor | Optional | AN127[\s\S]{1,127} | Can be used to populate all or part of the Merchant Name descriptor, which often appears on the first line of the shopper's statement. The full use of this field depends on the Merchant Account configuration. NOTE: merchant.name can override any data sent in this field. |

transactionSource | Conditional | AN32[a-zA-Z0-9_]{1,32} | Transaction Source is optional in payment request and it is mandatory in Reversal Transactions. The possible value maybe: CARDHOLDER, TOKEN,...etc. |

merchantInvoiceId | Optional | AN255[\s\S]{8,255} | Merchant-provided invoice number, should be unique for your transactions. This identifier is not sent onwards. |

merchantMemo | Optional | AN255[\s\S]{8,255} | Merchant-provided additional information. The information provided is not transaction processing relevant. It will appear in reporting only. |

transactionCategory | Optional | AN32[a-zA-Z0-9]{0,32} | The category of the transaction, possible values are: EC - eCommerce MO - Mail order TO - Telephone order RC - Recurring IN - Installment PO - POS PM - mPOS |

merchant.id | Mandatory | N15[0-9]{1,15} | Acquirer-assigned Merchant identifier. |

pos.terminalId | Optional | AN8[a-zA-Z0-9_]{1,8} | Terminal Id assigned by the acquirer. |

merchantTransactionId | Required | AN32[a-zA-Z0-9]{32} | Merchant-provided reference number, should be unique for your transactions. Some receivers require this ID. This identifier is often used for reconciliation. Each transaction requires a unique merchant transaction ID. The reversal and refund have their own merchant transaction ID, which is different from the original transaction. |

validityPeriod | Optional | N8 | Transaction will be closed automatically after the period. (Unit: millisecond) |

checkoutType | Optional | AN10[a-zA-Z0-9_]{1,10} | Transaction type of checkout page transaction. possible values are: AUTHORIZE Preauthorization: A stand-alone authorisation that will also trigger optional risk management and validation. A Capture (CP) with reference to the Preauthorisation (PA) will confirm the payment. PURCHASE Debits the account of the end customer and credits the merchant account. |

threeDSecure. indicator | Conditional | force/true | - The indicator will be ignored if the merchant 3DS authentication is not optional. force: The transaction need go through Risk System (such as DM), although it go through Risk System successfully, but it still go through 3DS System. true: need go through 3DS System. |

Payment Response Parameters

| Required | Format | Description | |

|---|---|---|---|

id(/payments) | Required | AN32[a-zA-Z0-9]{32} | The identifier of the payment request that can be used to reference the payment later. You get this as the field id of a payment's response. |

registrationId | Required | AN32[a-zA-Z0-9]{32} | The identifier of the registration request that can be used to reference the registration later. You get this either as the field id of a registration's response or as the field registrationId of a payment's response (if the request contained createRegistration=true). |

paymentBrand | Conditional | AN32[a-zA-Z0-9_] {1,32} | The payment brand of the request. |

amount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The amount of the request. |

currency | Conditional | A3[a-zA-Z]{3} | The currency of the request. |

descriptor | Conditional | AN127[\s\S]{1,127} | The descriptor of the request. |

result.code | Required | AN11[0-9.]{2,11} | - The unique code that indicates the result status of the request. See the result codes for more detailed information. |

result.description | Optional | AN255[\s\S]{0,255} | A textual description explaining the result.code's meaning. |

result.avsResponse | Conditional | A1[A-Z]{1} | Contains the AVS response returned by the acquirer. It may include one the following result: A = Address does match, zip code does not match Z = Address does not match, zip code does match N = Address and zip code do not match U = Technical or logical error. AVS cannot be applied on card or address (not UK or US issuer), issuer is not available, etc. F = Address and Postal Code Matches |

result.cvvResponse | Conditional | A1[A-Z]{1} | Contains the CVV response returned by the acquirer. It may include one the following result: M - CVV2 Match Indicates that the issuer was able to verify the CVV2 value provided by the merchant. N - CVV2, CVC2, Discover CID or AMEX CID do not match Indicates that the issuer was not able to verify the CVV2 value provided by the merchant. P - Not Processed Indicates that the issuer was unable to verify the CVV2 value provided by the merchant because either their verification system was not functioning, or not all of the information needed to verify the CVV2 value (such as the expiration date) was included in the request. S - CVV2, CVC2, Discover CID or AMEX CID data is not present on the card, but the issuer indicated it should be present Indicates that the issuer was unable to perform CVV2 verification, and notifies the merchant that the card should contain a CVV2 value. U - Unsupported by issuer or issuer is unable to process request Indicates that the issuer is not participating in the CVV2 service, or that the issue has not provided the card Brand with the required encryption keys needed to perform verification, or that STIP has responded with unavailable response. |

result.macResponse | Optional | AN02 | Merchant advice code from the acquirer. It may include one the following result: 01=New account information available 02=Cannot approve at this time, try again later 03=Do not try again 04=Token requirements not fulfilled for this token type 21=Payment Cancellation (Mastercard use only) 22=Merchant does not qualify for product code |

resultDetails | Optional | AN2048[\s\S]{0,2048} | A container for name value pair used for enriching the response with bank-specific response details. I.e. the actual parameters used within resultDetails are bank-specific. Example: resultDetails.AuthCode=123456 |

resultDetails. AcquirerResponse | Conditional | AN2048[\s\S]{0,2048} | Represents the acquirer original response code retrieved from the acquirer directly. |

card.bin | Optional | N6[\d]{6} | The first six digits of the card.number |

card.holder | Optional | N6[\d]{6} | Holder of the credit card account |

card.expiryMonth | Optional | N6[\d]{2} | The expiry month of the card |

card.expiryYear | Optional | N4[\d]{4} | The expiry year of the card |

merchant. bankAccount.holder | Required | AN128{4,128} | Holder of the merchant's bank account |

merchant. bankAccount.number | Conditional | AN64[a-zA-Z0-9]{3,64} | The account number of the merchant's bank account. (IBAN for SEPA accounts) |

merchant. bankAccount.bic | Conditional | AN11[a-zA-Z0-9]{8} | [a-zA-Z0-9]{11} |

merchant. bankAccount.country | Conditional | AN2[a-zA-Z]{2} | The country code of the merchant's bank account (ISO 3166-1). |

Other The response can also contain each of the data structures listed above, such as customer and billingAddress. n/a Conditional

| Required | Format | Description | |

|---|---|---|---|

buildNumber | Required | AN255[\s\S]{0,255} | Useful for support purposes. |

timestamp | Required | date yyyy-MM-dd hh:mm:ssZ | The timestamp the response has generated. |

ndc | Required | AN69[a-zA-Z0-9-]{1,69} | An internal unique identifier for the request. |

additionalData | Conditional | AN255[\s\S]{0,255} | Additional Data from the bank acquiring system / card schemes: • TraceAuditNo :STAN, • EntryMode POS Entry Mode (01 for MOTO and 81 for E-commerce. For CP transaction, the field is same as request) • EntryMode POS Entry Mode (01 for MOTO and 81 for E-commerce. For CP transaction, the field is same as request) • EntryMode POS Entry Mode (01 for MOTO and 81 for E-commerce. For CP transaction, the field is same as request) • ConditionCode: POS condition code (00 for card present transaction, 08 means MOTO and 59 means E-commerce transaction) • RetrievalRefNo: Retrieval Reference number • AcquirerRefno: Acquirer Reference Number of the Transaction(23 digits) • RequestId: Unique Transaction Reference ID from CYBS |

Payment

If you are fully PCI compliant, synchronous payment follow is recommended and asynchronous is also supported. In a synchronous workflow the payment data is sent directly in the server-to-server initial payment request and the payment is processed straight away.

If a customer pays with a card, a POST request is created over HTTPS to the baseUrl + resourcePath. The request should include all required information such as your authentication credentials, the type of transaction, the amount and the payment information such as card details. A payment request effectively combines a PA and capture request, automatically requesting that the funds are cleared if the authorization was successful.

resourcePath=/pay/v3/payments

curl http://host:port/pay/v3/payments \

-d "entityId=tEntity1" \

-d "entityType=PARTICIPATOR" \

-d "amount=92.00" \

-d "currency=CNY" \

-d "paymentBrand=VISA" \

-d "paymentType=DB" \

-d "card.number=4200000000000000" \

-d "card.holder=Jane Jones" \

-d "card.expiryMonth=06" \

-d "card.expiryYear=2020" \

-d "merchantTransactionId=2020020asd30050044" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5MjIwMDE1Y2N8c3k2S0pzVDg="

curl http://host:port/pay/v3/payments \

-d "entityId=tEntity1" \

-d "entityType=PARTICIPATOR" \

-d "amount=50.00" \

-d "currency=CNY" \

-d "paymentBrand=VISA" \

-d "paymentType=DB" \

-d "card.token=23fg542983darr32fhsfs411isfgsr34q" \

-d "merchantTransactionId=20220201asd254211" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5Mj2345234sfg5ewgff145ad="

Once a payment is done, you will get a response from Eastpay payment Gateway.

\{

"id":"8ac7a4a27706b4b401770a6d346c0ff0",

"paymentType":"DB",

"paymentBrand":"VISA",

"amount":"92.00",

"currency":"EUR",

"result":\{

"code":"000.000.000",

"description":"Transaction successfully proceeded"

},

"resultDetails":\{

"clearingInstituteName":"EastPay"

},

"card":\{

"bin":"420000",

"last4Digits":"0000",

"holder":"Jane Jones",

"expiryMonth":"05",

"expiryYear":"2034"

},

"buildNumber":"5a76591c8e1d872b883720a8d9d82d2bc1ff8199@2020-01-15 07:59:05 +0000",

"timestamp":"2020-01-16 09:01:05.208+0000",

"ndc":"8a8294174b7ecb28014b9699220015ca_71665329ea9642e19b409bb793a9b80f"

}

Set Exchange Rate

One can also initiate a request for setting exchange rates through the exchange rate API. Functions of this API are self-explanatory through looking at the parameters.

| Parameter | Description | Format | Required |

|---|---|---|---|

| exchangeRate.currency | The currency whose exchange rate is to be set | A3,[A-Z] | Required |

| exchangeRate.effectiveDate | The date when this exchange rate gets effective | YYYYMMDD | Required |

| exchangRate.buyingRate | The exchange rate for buying this target currency, at most 5 decimals | N2.N5 [0-9]{1,10}(\.[0-9]{2})? | Required |

| exchangeRate.sellingRate | The exchange rate for selling this target currency, at most 5 decimals | N2.N5 [0-9]{1,10}(\.[0-9]{2})? | Required |

resourcePath=/v3/exchangerate/create

Preauthorization

A Preauthorization is created by sending a POST request over HTTPS to baseUrl + resourcePath. The request should include all required information such as your authentication credentials, the type of transaction, the amount and the payment information such as card details. A capture may be sent against a successful PA to request that the funds are sent for clearing.

resourcePath=/pay/v3/payments

curl http://host:port/pay/v3/payments \

-d "entityId= Entity1" \

-d "entityType=PARTICIPATOR" \

-d "amount=92.00" \

-d "currency=CNY" \

-d "paymentBrand=MASTER" \

-d "paymentType=PA" \

-d "card.number=5454545454545454" \

-d "card.holder=Jane Jones" \

-d "card.expiryMonth=06" \

-d "card.expiryYear=2020" \

-d "card.cvv=123" \

-d "merchantTransactionId=2020020asd30051122" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5MjIwMDE1Y2N8c3k2S0pzVDg="

The sample response is the following

\{

"id":"8ac7a4a07706b4b301770a1ac39444bc",

"paymentType":"PA",

"paymentBrand":"",

"amount":"92.00",

"currency":"EUR",

"descriptor":"1910.4169.5658 OPP_Channel ",

"result":\{

"code":"000.000.000",

"description":"Transaction successfully proceeded"

},

"resultDetails":\{

"clearingInstituteName":"EastPay"

},

"card":\{

"bin":"545454",

"last4Digits":"5454",

"holder":"Jane Jones",

"expiryMonth":"05",

"expiryYear":"2034"

},

"buildNumber":"5a76591c8e1d872b883720a8d9d82d2bc1ff8199@2020-01-15 07:59:05 +0000",

"timestamp":"2020-01-16 07:31:02.325+0000",

"ndc":"8a8294174b7ecb28014b9699220015ca_9e961b25b9f64108ac0e7fb3bf690e48"

}

Capture

A capture is used to request clearing for previously authorized funds. A capture request is performed against a previous preauthorization (PA) payment by referencing its payment.id. Captures can be for full or partial amounts and multiple capture requests against the same PA are allowed.

resourcePath=/pay/v3/payments/

curl http://host:port/pay/v3/payments /{id}\

-d "entityId= tEntity1" \

-d "entityType=PARTICIPATOR" \

-d "paymentType=CP" \

-d "amount=92.00" \

-d "currency=CNY" \

-d "originalTransactionId=123123123" \

-d "merchantTransactionId= 202001160848001120000" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5MjIwMDE1Y2N8c3k2S0pzVDg="

Response Sample:

\{

"id":"8ac7a4a07706b4b301770a61d9af08bc",

"referencedId":"8ac7a4a07706b4b301770a61818707f5",

"paymentType":"CP",

"result":\{

"code":"700.400.100",

"description":"cannot capture (PA value exceeded)"

},

"buildNumber":"5a76591c8e1d872b883720a8d9d82d2bc1ff8199@2020-01-15 07:59:05 +0000",

"timestamp":"2020-01-16 08:48:40.879+0000",

"ndc":"8a8294174b7ecb28014b9699220015ca_a4feddf631c74928b5d9c68d38916862"

}

Reversal

A reversal is performed against a previous payment, referencing its payment.id. A reversal can be sent against debit (DB) or preauthorization (PA) payment types.

Parameters

| Required | Format | Description | |

|---|---|---|---|

transactionSource | Optional | AN32[a-zA-Z0-9_]{1,32} | Used to indicate the type of reversal. CARDHOLDER: The reversal is initiated by cardholder. Usually it is a VOID transaction.ERROR: If the original transaction encounters a failure, this reason is used to initiate a reversal. PARTIAL: For partial reversal , please use this source type and send the reversal amount in referral request. SUSPECT: The reversal is caused by the suspected fraud TIMEOUT: The response received late of the original transaction. |

resourcePath=/pay/v21/payments

curl http://host:port/pay/v3/payments \

-d "entityId= tEntity1" \

-d"entityType=PARTICIPATOR" \

-d "paymentType=RV" \

-d "originalTransactionId=123123123" \

-d "merchantTransactionId=2020020asd30051234" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5MjIwMDE1Y2N8c3k2S0pzVDg="

Request Response

\{

"id":"8ac7a4a27706b4b401770a70528d1225",

"referencedId":"8ac7a4a27706b4b401770a6d346c0ff0",

"paymentType":"RV",

"result":\{

"code":"700.400.300",

"description":"cannot reverse (already refunded|reversed, invalid workflow or amount exceeded)"

},

"buildNumber":"5a76591c8e1d872b883720a8d9d82d2bc1ff8199@2020-01-15 07:59:05 +0000",

"timestamp":"2020-01-16 09:04:29.325+0000",

"ndc":"8a8294174b7ecb28014b9699220015ca_1eb84f93b76741518e2ac16d3d047983"

}

Inquiry

Transaction inquiry using merchantTransaction ID

curl -G https://host:port/pay/v3/payments/{transaction.id} \

-d "entityId= tEntity1" \

-d "entityType=PARTICIPATOR" \

-d "merchantTransactionId=test123" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5MjIwMDE1Y2N8c3k2S0pzVDg="

The Sample response is

\{

"result":\{

"code":"000.000.100",

"description":"successful request"

},

"buildNumber":"891f0b23df90eace0edc0f2010d685f7d60133dc@2021-01-28 11:06:16 +0000",

"timestamp":"2021-01-29 10:52:45+0000",

"ndc":"8a8294174b7ecb28014b9699220015ca_bfdfa7ca8d4049bda46d01bad02e69b0",

"id":"8ac7a4a0673bd9e40167415ff34c7c9a",

"referencedId":"8ac7a4a1673bc79501674152b57b3d11",

"paymentType":"RC",

"paymentBrand":"MC",

"amount":"100.12",

"currency":"EUR",

"merchantMemo":"",

"merchantTransactionId":"test123",

"result":\{

"code":"000.000.000",

"description":"Request successfully processed"

},

"customer":\{

"givenName":"Test",

"surname":"User",

"email":"nomad._1184002955_per@gmail.com"

},

"billing":\{

"street1":"1 Main St 1 Main St 2",

"city":"San Jose",

"state":"CA",

"postcode":"95131",

"country":"US"

},

"customParameters":\{

"INFO_matchingAlgorithm":"MANUAL_MATCH"

},

"timestamp":"2020-11-23 16:21:06.558+0000",

"virtualAccount":\{

"accountId":"nomad._1184002955_per@gmail.com",

"holder":"Test User"

}

}

Refund

A refund is performed against a previous payment, referencing its payment.id by sending a POST request. A refund can be performed against Payment (DB) or captured preauthorization (PA->CP) payment types. Where supported, the amount field can be used to process a partial or full amount.

resourcePath=/pay/v3/payments

curl http://host:port/pay/v3/payments/{id}\

-d "entityId=8a8294174b7ecb28014b9699220015ca" \

-d "amount=10.00" \

-d "currency=EUR" \

-d "paymentType=RF" \

-d "originalTransactionId=123123123" \

-d "merchantTransactionId=2020020asd30050044" \

-H "Authorization: Bearer OGE4Mjk0MTc0YjdlY2IyODAxNGI5Njk5MjIwMDE1Y2N8c3k2S0pzVDg="

Response Sample:

\{

"id":"8ac7a4a07706b4b301770a782eb924c1",

"referencedId":"8ac7a49f7706aa4d01770a77b65058c8",

"paymentType":"RF",

"result":\{

"code":"700.400.520",

"description":"refund needs at least one successful transaction of type (CP or DB)"

},

"buildNumber":"5a76591c8e1d872b883720a8d9d82d2bc1ff8199@2020-01-15 07:59:05 +0000",

"timestamp":"2020-01-16 09:13:04.442+0000",

"ndc":"8a8294174b7ecb28014b9699220015ca_0c8eeebd4f6940e8a246116d6bfbc1c7"

}

3D-Secure Transaction

3DS2 Information

For users who are integrating via server to server will need to prepare your front-end and back-end and send the following additional information along with the payment information :

Parameters

| Field | API Field name | Description | Length/Format/Values |

|---|---|---|---|

| Accept header | customer.browser. acceptHeader | HTTP accept header sent from the cardholder's browser. | Length: Variable, maximum 2048 characters JSON Data Type: String Value accepted: If the total length of the accept header sent by the browser exceeds 2048 characters, the 3DS Server truncates |

| Language | customer.browser. language | The cardholder's browser language. | Length: Variable, 1–8 characters JSON Data Type: String |

| Screen height | customer.browser. screenHeight | This field contains the total height of the cardholder's screen in pixels. | Length: Variable, 1–6 characters JSON Data Type: String |

| Screen width | customer.browser. screenWidth | This field contains the total width of the cardholder's screen in pixels. | Length: Variable, 1–6 characters JSON Data Type: String |

| Browser timezone | customer.browser. timezone | This field contains the cardholder's browser local timezone. | Length: 1–5 characters JSON Data Type: String Value accepted: Value is returned from the getTimezoneOffset() method. |

| User agent | customer.browser. userAgent | This field contains the exact content of the HTTP User-Agent header. | Length: Variable, maximum 2048 characters JSON Data Type: String Value accepted: Note: If the total length of the User-Agent sent by the browser exceeds 2048 characters, the 3DS Server truncates the excess portion. |

| IP address | customer.ip | IP address of the cardholder's browser. | Length: Variable, maximum 45 characters JSON Data Type: String Value accepted: IPv4 address is represented in the dotted decimal format of 4 sets of decimal numbers separated by dots. The decimal number in each and every set is in the range 0 to 255. Example IPv4 address: 1.12.123.255 IPv6 address is represented as eight groups of four hexadecimal digits, each group representing 16 bits (two octets. The groups are separated by colons (:). Example IPv6 address:2011:0db8:85 a3:0101:0101:8a2e:03 70:7334 |

| Java enabled | customer.browser. javaEnabled | true/false - Ability of the cardholder's browser to execute Java. | JSON Data Type: Boolean Values accepted: • true • false |

| Javascript enabled | customer.browser. javascriptEnabled | true/false - Ability of the cardholder's browser to execute JavaScript | JSON Data Type: Boolean Values accepted: • true • false |

| Screen color depth | customer.browser. screenColorDepth | This field contains a value representing the bit depth of the color palette, in bits per pixel, for displaying images. | Length: 1–2 characters JSON Data Type: String Values accepted: 1 = 1 bit • 4 = 4 bits • 8 = 8 bits • 15 = 15 bits • 16 = 16 bits • 24 = 24 bits • 32 = 32 bits • 48 = 48 bits |

| Authentication window size | customer.browser. challengeWindow | Size of the authentication iframe which will render the ACS authentication front-end to the shopper for interaction. | Please send an Integer between 1-5. The integer corresponds to one the following resolutions: () () |

Reqeust and Response

- Send the request with 3DS information

- Handle Method Data and Method URL if issuer returned in an immediate response (optional step) ; If the issuer

- Receive the final response

After you sent the request with 3DS information , you will get an immediate response with Method Data and Method URL which returned by issuer. It is an optional step, but if it's returned it's important to handle it properly.

-

Request Sample:

authentication.entityId=8ac7a49f6e4a18ae016e4b8b4c4b2146

amount=12.00

currency=EUR

paymentBrand=VISA

paymentType=PA

merchantTransactionId=order99234

transactionCategory=EC

card.number=4000000000000010

card.expiryMonth=12

card.expiryYear=2025

card.cvv=123

card.holder=John Smith

merchant.name=MerchantCo

merchant.city=Munich

merchant.country=DE

merchant.mcc=5399

customer.ip=192.168.0.1

customer.browser.acceptHeader=text/html

customer.browser.screenColorDepth=48

customer.browser.javaEnabled=false

customer.browser.language=de

customer.browser.screenHeight=1200

customer.browser.screenWidth=1600

customer.browser.timezone=60

customer.browser.challengeWindow=4

customer.browser.userAgent=Mozilla/4.0 (MSIE 6.0; Windows NT 5.0)

shopperResultUrl="https://host:port/xxx" -

Get Optional Response with Method Data and Method URL:

\{

"id": "8ac7a4a0686138d701687eebfbc74747",

"paymentType": "DB",

"paymentBrand": "VISA",

"result": \{

"code": "000.200.000",

"description": "transaction pending"

},

"resultDetails": \{

"clearingInstituteName": "CI_Test"

},

"card": \{

"bin": "411111",

"last4Digits": "1111",

"holder": "Jane Jones",

"expiryMonth": "05",

"expiryYear": "2020"

},

"redirect": \{

"url": "https://host:port/v3/threeDSecure/execute",

"parameters": [\{

"name": "name",

"value": "value"

}],

},

"buildNumber": "deebd8c9af7d84ddee98c38b7f4afcc814012b5b@2019-01-22 13:58:00 +0000",

"timestamp": "2019-01-24 08:13:41+0000",

"ndc": "8a8294174b7ecb28014b9699220015ca_0557df43f75643d19479440642979e00"

}

In immediate response , Method Data and Method URL are not always returned by the issuer. If your get Method Data and Method URL, you shouldRedirect the shopper within and iframe to the redirect URL if onload event received from 1.

<form name='' action='redirect.URL' method='POST'>

<INPUT type='hidden' name='redirect.parameters[n].name' value='redirect.parameters[].value'>

</form>

<script>

window.onload = submitForm;

function submitForm() \{ downloadForm.submit(); }

</script>

Parameters:

| Required | Format | Description | |

|---|---|---|---|

redirect.url | Conditional | AN2048[\s\S]{6,2048} | URL the shopper must be redirected to in order to proceed. |

redirect. parameters[n].name | Conditional | AN255[\s\S]{1,255} | List of parameter names for the redirect.url. The corresponding parameter value is the same parameter number ending with .value like described in the line below. |

redirect. parameters[n].value | Conditional | AN255[\s\S]{1,255} | The parameter values corresponding to the names as described above. |

-

Get final response:

shopperResultUrl in request will receive the final response.

\{

"id":"8ac7a49f6e4a18ae016e4b8b4c4b2146",

"paymentType":"PA",

"paymentBrand":"VISA",

"amount":"12.00",

"currency":"EUR",

"result":\{

"code":"000.100.112",

"description":"Request successfully processed in 'Merchant in Connector Test Mode'"

},

"resultDetails":\{

"ExtendedDescription":"Approved",

"AcquirerResponse":"00",

},

"card":\{

"bin":"400000",

"last4Digits":"0044",

"expiryMonth":"12",

"expiryYear":"2025"

},

"threeDSecure":\{

"eci":"05",

"verificationId":"MTIzNDU2Nzg5MDEyMzQ1Njc4OTA=",

"version":"2.1.0",

"dsTransactionId":"91caca63-5c4e-4aa2-a3f1-b4d418972de8",

"acsTransactionId":"7055d78e-eb35-46e7-8c4e-56e15092b5f5",

},

"buildNumber":"7810ceecdd913cd9c4807becb99b89ce68454900@2019-11-08 12:20:52 +0000",

"timestamp":"2019-11-08 15:05:42+0000",

"ndc":"8ac7a4c76dd857ea016dda2ea6970684_3ba4c7691f854354906b2f6c402840e7"

}

Optional 3DS Information

Please note that in order to have a better rate of successful risk-checks during the risk based authentication, it is recommended to send as many fields as possible. This will positively affect the number of frictionless flows.

Parameters

Field name | Mandatory/Optional | Source when integrating via Server-to-Server API | Format, Length |

|---|---|---|---|

billing.city | Required unless market or regional mandate restricts sending this information. | Cardholder (via API) | Length: Variable, 2–45 characters Format: String with values accepted indicated below |

billing.country | Required unless market or regional mandate restricts sending this information. | Cardholder (via API) | Length: 2 characters Format: [A-Z]{2} |

billing.street1 | Required unless market or regional mandate restricts sending this information. | Cardholder (via API) | Length: Variable, maximum 50 characters Format: String |

billing.postcode | Required unless market or regional mandate restricts sending this information. | Cardholder (via API) | Length: Variable, maximum 50 characters Format: String |

customer.email | Required unless market or regional mandate restricts sending this information. | Cardholder (via API) | Length: Variable, maximum 128 characters Format: String |

card.holder | Required unless market or regional mandate restricts sending this information. | Cardholder (via API) | Length: Variable, maximum 128 characters Format: String |

amount | Mandatory | Payment (via API) | Length: Variable, maximum 12 characters Format: Numeric with 2 minor units after the decimal point Example: 123.00 |

currency | Mandatory | Payment (via API) | Length: 3 characters Format: ISO 4217 A3 currency code |

shipping.city | Optional | Cardholder (via API) | Length: Variable, maximum 50 characters Format: String |

shipping.country | Optional | Cardholder (via API) | Length: 3 characters Format: ISO 3166-1 A2 country code |

shipping.street1 | Optional | Cardholder (via API) | Length: Variable, maximum 50 characters Format: String |

shipping.street2 | Optional | Cardholder (via API) | Length: Variable, maximum 50 characters Format: String |

shipping.postcode | Optional | Cardholder (via API) | Length: Variable, maximum 16 characters Format: String |

shipping.state | Optional | Cardholder (via API) | Length: Variable: maximum 3 characters Format: Should be the country subdivision code defined in ISO 3166-2 |

billing.street2 | Optional | Cardholder (via API) | Length: Variable, maximum 50 characters Format: String |

billing.state | Optional | Cardholder (via API) | Length: Variable: maximum 3 characters Format: Should be the country subdivision code defined in ISO 3166-2 |

customer.phone | Optional | Cardholder (via API) | Length: Variable: maximum 20 characters Format: +ccc-nnnnnnnn Where: + sign is optional cc - country code, maximum 3 characters "-" - mandatory character nnnnnnnnnn - phone number without the country code, maximum 15 characters |

customer.workPhone | Optional | Cardholder (via API) | Length: Variable: maximum 20 characters Format: +ccc-nnnnnnnn Where: + sign is optional cc - country code, maximum 3 characters "-" - mandatory character nnnnnnnnnn - phone number without the country code, maximum 15 characters |

customer.mobile | Optional | Cardholder (via API) | Length: Variable: maximum 20 characters Format: +ccc-nnnnnnnn Where: + sign is optional cc - country code, maximum 3 characters "-" - mandatory character nnnnnnnnnn - phone number without the country code, maximum 15 characters |

customer.browser. acceptHeader | Mandatory | Merchant should collect and send via API | Length: Variable, maximum 2048 characters Format: String |

customer.browser. language | Mandatory | Merchant should collect and send via API | Length: Variable, 1–8 characters Format: String Returned from navigator.language property. |

customer.browser. screenHeight | Mandatory when customer.browser. javascriptEnabled = true; otherwise Optional | Merchant should collect and send via API | Length: Variable, 1–6 Format: Numeric Value is returned from the screen.height property |

customer.browser. screenWidth | Mandatory when customer.browser. javascriptEnabled = true; otherwise Optional | Merchant should collect and send via API | Length: Variable, 1–6 Format: Numeric Value is returned from the screen.width property |

customer.browser. timezone | Mandatory when customer.browser. javascriptEnabled = true; otherwise Optional | Merchant should collect and send via API | Length: Variable, 1–5 characters Format: Numeric Value is returned from the getTimezoneOffset() method. |

customer.browser. userAgent | Mandatory | Merchant should collect and send via API | Length: Variable, maximum 2048 characters Format: String |

customer.ip | Optional | Merchant should collect and send via API | Length: Variable, maximum 45 characters Format: IPv4 address Example: 1.12.123.255 |

customer.browser. javaEnabled | 3DS 2.1 : Mandatory 3DS 2.2: Mandatory when customer.browser. javascriptEnabled = true; otherwise Optional | Merchant should collect and send via API | Values accepted: • true • false Value is returned from the navigator.javaEnabled property. |

customer.browser. javascriptEnabled | Mandatory | Merchant should collect and send via API | Values accepted: • true • false |

customer.browser. screenColorDepth | 3DS 2.1 : Mandatory 3DS 2.2: Mandatory when customer.browser. javascriptEnabled = true; otherwise Optional | Merchant should collect and send via API | Length: 1–2 characters Format: String Values accepted: • 1 = 1 bit • 4 = 4 bits • 8 = 8 bits • 15 = 15 bits • 16 = 16 bits • 24 = 24 bits • 32 = 32 bits • 48 = 48 bits |

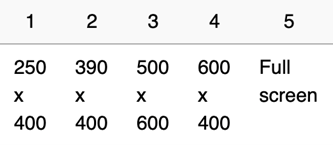

customer.browser. challengeWindow | Optional | Merchant should collect and send via API | Length: 2 characters Values accepted: • 01 = 250 x 400 • 02 = 390 x 400 • 03 = 500 x 600 • 04 = 600 x 400 • 05 = Full screen |

threeDSecure.amount | Optional | Sent via the API | Length: Variable, maximum 12 characters Format: Numeric with 2 minor units after the decimal point Example: 123.00 |

threeDSecure.currency | Optional | Sent via the API | Length: 3 characters Format: ISO 4217 A3 currency code |

Authentication Amount and Currency

In some cases the amount and/or currency that is used in the authentication can be different from the one that will be used in the payment later. For example the payment amount might not be known at the time of the authentication, or the merchant would like to authenticate the shopper for the full amount when the payment will be done in multiple installments.

If the authentication amount and the payment amount are different, then the authentication amount and currency can be sent in a separate fields:

| feild | desc |

|---|---|

threeDSecure.amount | Amount for which the shopper will be authenticated for. |

threeDSecure.currency | Currency for which the shopper will be authenticated for. |

Please note that payment amount and currency are still mandatory fields for any payment request. If there are no authentication amount and currency defined then the shopper will be authenticated with the payment amount and currency.

Optional Setting

Challenge Indicator

Merchants have the possibility to set the preference of a transaction being challenged or not. This really is only a preference, and won't guarantee that the issuer will or will not request a challenge from the cardholder. It is up to the issuer if they consider the merchant's preference, and if they include it when they assess the risk of the transaction.

For example when a card is being stored for later use (e.g. for One click checkout), a challenge may be requested by the merchant. In another example, there might be some regional mandates that certain transactions have to be challenged and the merchant should ask for a mandated challenge.

Send the field threeDSecure.challengeIndicator with one of the following values:

Value Challenge Preference Description

| Value | Challenge Preference | Description |

|---|---|---|

01 | No preference | The merchant has no preference, and fully trust the issuer to ask a challenge from the cardholder. |

02 | No challenge requested | The merchant prefers that the cardholder is not authenticated by the issuer, and only the frictionless flow applies |

03 | Challenge requested: 3D Secure Requestor Preference | The merchant prefers that the cardholder is authenticated by the issuer. |

04 | Challenge requested: Mandate | The cardholder authentication is mandated (e.g. by regional mandates) |

The field threeDSecure.challengeIndicator is optional. If not sent, the value "01 - No preference" applies by default.

Cardholder history with merchant

The following fields are not mandatory, but it is strongly recommended to send them. They are affecting the accuracy of the issuer's risk check, and will result in more frictionless flows.

Parameters

customParameters[ReqAuthMethod]

- Method used by the Cardholder to authenticate to the 3D Secure Requestor. Contains optional information about how

the cardholder authenticated during login to their 3D Secure Requestor account. Possible values are:

- 01 No authentication occurred (i.e. cardholder "logged in" as guest)

- 02 Login to the cardholder account at the merchant system using cardholder's own credentials

- 03 Login to the cardholder account at the merchant system using federated ID

- 04 Login to the cardholder account at the merchant system using issuer credentials

- 05 Login to the cardholder account at the merchant system using third-party authentication

- 06 Login to the cardholder account at the merchant system using FIDO Authenticator

customParameters[ReqAuthTimestamp]

- Date and time in UTC of the cardholder authentication. Accepted date format is YYYYMMDDHHMM. Part of the 3D Secure Requestor Authentication Information which contains optional information about how the cardholder authenticated during login to their account.

customParameters[PriorAuthMethod]

- Mechanism used by the Cardholder to previously authenticate to the 3D Secure Requestor. Contains information about

a 3D Secure cardholder authentication that occurred prior to the current transaction. Possible values are:

- 01 Frictionless authentication occurred by ACS

- 02 Cardholder challenge occurred by ACS

- 03 ACS verified

- 04 Other issuer methods

customParameters[PriorAuthTimestamp]

- Date and time in UTC of the prior cardholder authentication. Accepted date format is YYYYMMDDHHMM. Contains information about a 3D Secure cardholder authentication that occurred prior to the current transaction.

customParameters[PriorReference]

- This data element provides additional information to the ACS to determine the best approach for handling a request. It contains an ACS Transaction ID for a prior authenticated transaction (for example, the first recurring transaction that was authenticated with the cardholder).

- Contains information about a 3D Secure cardholder authentication that occurred prior to the current transaction.

customParameters[AccountId]

- Additional information about the account optionally provided by the 3D Secure Requestor in AReq messages.

customParameters[AccountAgeIndicator]

- Length of time that the cardholder has had the account with the 3D Secure Requestor. Possible values are:

- 01 No account (guest check-out)

- 02 Created during this transaction

- 03 Less than 30 days

- 04 30-60 days

- 05 More than 60 days

customParameters[AccountChangeDate]

- Date that the cardholder's account with the 3D Secure Requestor was last changed. Accepted date format is YYYYMMDD.

customParameters[AccountChangeIndicator]

- Length of time since the cardholder's account information with the 3D Secure Requestor was last changed. Possible values are:

- 01 Created during this transaction

- 02 Less than 30 days

- 03 30-60 days

- 04 More than 60 days

customParameters[AccountDate]

- Date that the cardholder opened the account with the 3D Secure Requestor. Accepted date format is YYYYMMDD.

customParameters[AccountPasswordChangeDate]

- Date that cardholder's account with the 3D Secure Requestor had a password change or account reset. Accepted date format is YYYYMMDD.

customParameters[AccountPasswordChangeIndicator]

- Indicates the length of time since the cardholder's account with the 3D Secure Requestor had a password change or account

reset. Possible values are:

- 01 No account (guest check-out)

- 02 Created during this transaction

- 03 Less than 30 days

- 04 30-60 days

- 05 More than 60 days

customParameters[AccountPurchaseCount]

- Number of purchases with this cardholder account during the previous six months.

customParameters[AccountProvisioningAttempts]

- Number of Add Card attempts for the account in the last 24 hours.

customParameters[AccountDayTransactions]

- Number of transactions (successful and abandoned) for this cardholder account with the 3D Secure Requestor across all ayment accounts in the previous 24 hours.

customParameters[AccountYearTransactions]

- Number of transactions (successful and abandoned) for this cardholder account with the 3D Secure Requestor across all payment accounts in the previous year.

customParameters[PaymentAccountAge]

- Date that the payment account was enrolled in the cardholder's account with the 3D Secure Requestor. Accepted date format is YYYYMMDD.

customParameters[PaymentAccountAgeIndicator]

- Indicates the length of time that the payment account was enrolled in the cardholder's account with the 3D Secure

Requestor. Possible values are:

- 01 No account (guest check-out)

- 02 Created during this transaction

- 03 Less than 30 days

- 04 30-60 days

- 05 More than 60 days

customParameters[ShipAddressUsageDate]

- Date when the shipping address used for this transaction was first used with the 3D Secure Requestor. Accepted date format is YYYYMMDD.

customParameters[ShipAddressUsageIndicator]

- Indicates the length of time since the shipping address used for this transaction was first used with the 3D

Secure Requestor. Possible values are:

- 01 No account (guest check-out)

- 02 Created during this transaction

- 03 Less than 30 days

- 04 30-60 days

- 05 More than 60 days

customParameters[ShipIndicator]

- Indicates shipping method chosen for the transaction. Merchants must choose the Shipping Indicator code that most

accurately describes the cardholder's specific transaction, not their general business. If one or more items are

included in the sale, the Shipping Indicator code for the physical goods is used, or if all digital goods, the

Shipping Indicator code that describes the most expensive item. Possible values are:

- 01 Ship to cardholder's billing address

- 02 Ship to another verified address on file with merchant

- 03 Ship to address that is different than the cardholder's billing address

- 04 "Ship to Store" / Pick-up at local store (Store address shall be populated in shipping address fields)

- 05 Digital goods (includes online services, electronic gift cards and redemption codes)

- 06 Travel and Event tickets, not shipped

- 07 Other (for example, Gaming, digital services not shipped, emedia subscriptions, etc.)

customParameters[ShipNameIndicator]

- Indicates if the Cardholder Name on the account is identical to the shipping Name used for this transaction.

Possible values are:

- 01 Account Name identical to shipping Name

- 02 Account Name different than shipping Name

customParameters[SuspiciousAccountActivity]

- Indicates whether the 3D Secure Requestor has experienced suspicious activity (including previous fraud) on

the cardholder account. Possible values are:

- 01 No suspicious activity has been observed

- 02 Suspicious activity has been observed

customParameters[TransactionType]

- Identifies the type of transaction being authenticated. Possible values are:

- 01 Goods / Service Purchase

- 03 Check Acceptance

- 10 Account Funding

- 11 Quasi-Cash Transaction

- 28 Prepaid Activation and Load

customParameters[DeliveryTimeframe]

- Indicates the merchandise delivery timeframe. Possible values are:

- 01 Electronic Delivery

- 02 Same Day Shipping

- 03 Overnight Shipping

- 04 Two-day or more shipping

customParameters[DeliveryEmailAddress]

- For Electronic delivery, the email address to which the merchandise was delivered.

customParameters[ReorderItemsIndicator]

- Indicates whether the cardholder is reordering previously purchased merchandise. Possible values are:

- 01 First time ordered

- 02 Reordered

customParameters[PreOrderPurchaseIndicator]

- Indicates whether Cardholder is placing an order for merchandise with a future availability or release date.

Possible values are:

- 01 Merchandise available

- 02 Future availability

customParameters[PreOrderDate]

- For a pre-ordered purchase, the expected date that the merchandise will be available.

- Date format = YYYYMMDD

customParameters[GiftCardAmount]

- For prepaid or gift card purchase, the purchase amount total of prepaid or gift card(s) in major units (for example, USD 123.45 is 123).

customParameters[GiftCardCurrency]

- For prepaid or gift card purchase, ISO 4217 three-digit currency code of the gift card.

customParameters[GiftCardCount]

- For prepaid or gift card purchase, total count of individual prepaid or gift cards/codes purchased.

Submit a Pre-Authenticated Payment Request

If you have used an external 3DS MPI to authenticate the payer, then you must pass information about the authentication in payment request. Please set threeDSeucre.indicator=third. And if 3DS authentication fails, below information is not available. It is recommended not to send this group of information with failed authentication.

Parameters

| Required | Format | Description | |

|---|---|---|---|

threeDSecure. indicator | AN2048 | The indicator will be ignored if the merchant 3DS authentication is not optional. force: The transaction need go through Risk System (such as DM), although it go through Risk System successfully, but it still go through 3DS System. true: need go through 3DS System. third: If you will provide pre-authenticated information Mandatory | |

threeDSecure. authenticationStatus | Mandatory | AN(1) | Indicates the result of payer authentication with the issuer. |

threeDSecure.eci | Mandatory | N2 | The Electronic Commerce Indicator that is returned to you in the authentication response message. |

threeDSecure. verificationId | Mandatory | The base64 encoded value generated by the card issuer that is returned to you in the authentication response message | |

threeDSecure. dsTransactionId | Mandatory | A unique transaction identifier generated for the 3DS authentication. This field corresponds to the identifier assigned by the scheme directory server. |

Optional Information

Risk Screening Indicator

Request parameters

| Required | Format | Description | |

|---|---|---|---|

risk.ind | Optional | AN1 | Risk Indicator |

risk.systemID | Conditional | AN32[\s\S] {2,32} | - Risk System ID : CYBSDM、 ACIRS、 INTERNAL |

Response parameters

| Required | Format | Description | |

|---|---|---|---|

risk.score | Optional | AN32 | Risk Score from Risk system |

risk.decision | Conditional | AN32[\s\S] {2,32} | Decision from Risk system: DECLINE、ACCEPT、 CHALLENGE |

Customer Information

The customer data structure holds information about the customer/shopper such as their name, identification documents and contact details. The customer fields serve mixed purposes: On the one hand they are just for you to store information on your customers, but on the other hand they are also used and sometimes required for risk management and payment providers that require ID/mandate information.

Parameters

| Required | Format | Description | |

|---|---|---|---|

customer. merchantCustomerId | Conditional | AN100[\s\S]{1,100} | An identifier for this customer. Typically this is the ID that identifies the shopper in the shop's system. |

customer.givenName | Conditional | AN48[\s\S]{1,48} | The first name or given name of the customer. Required if you send in any other customer parameters, also required for some risk checks and payment providers. Will be truncated after 48 characters |

customer.middleName | Optional | AN48[\s\S]{1,48} | The middle name of the customer. |

customer.surname | Conditional | AN[\s\S]{1,48} | The last name or surname of the customer. Required if you send in any other customer parameters, also required for some risk checks and payment providers. Will be truncated after 48 characters |

customer.sex | Optional | M|F | Sex of the shopper, 'M' for male or 'F' for female A1 |

customer.birthDate | Conditional | AN10 {19|20)([0-9]{2})-(0[1-9]|1[0-2])-(0[1-9]|1[0-9]|2[0-9]|3[0-1]} | The birth day of the customer in the format yyyy-MM-dd, e.g. 1970-02-17 |

customer.phone | Optional | AN15[+0-9][0-9 .()/-]{7,25} | The customer's phone number. Required for some risk checks. |

customer.mobile | Optional | AN25[+0-9][0-9 .()/-]{5,25} | The customer's mobile number. Required for some risk checks. |

customer.workPhone | Optional | AN25[\s\S]{1,25} | The customer's phone number. Required for some risk checks. |

customer.email | Optional | AN128[\s\S]{6,128} | The customer's email address. Required for some risk checks and transmission of direct debit mandates. |

customer.companyName | Optional | AN60[\s\S]{1,60} | The customer's company name. |

customer. identificationDocType | Conditional | A12[\s\S] | The type of identification document for the customer. Can be one of these three values: IDCARD, PASSPORT, TAXSTATEMENT. If this parameter is sent then customer.identificationDocId must be also sent. It is also mandatory for certain payment types (e.g. Boleto). |

customer. identificationDocId | Conditional | AN64[\s\S]{8,64} | The identifier of the identification document for the customer. If this parameter is sent then customer.identificationDocType must also be sent. It is also mandatory for certain payment types (e.g. Boleto). |

customer.ip | Optional | AN255[\s\S]{1,255} | The customer's IP address. |

customer. browserFingerprint.id | Optional | [\s\S]{1,255} | The reference to the fingerprint of the shopper's browser, in most cases provided by some JavaScript library. |

customer. browserFingerprint.value | Optional | [\s\S]{1,4096} | The actual fingerprint value of the shopper's browser |

customer.browser. acceptHeader | Conditional | [\s\S]{1,2048} | Exact content of the HTTP accept headers as sent to the 3DS Requestor from the Cardholder’s browser. Mandatory for 3DS v2. |

customer.browser. language | Conditional | [\s\S]{1,8} | Value representing the browser language as defined in IETF BCP47. Returned from navigator.language property. Mandatory for 3DS v2. |

customer.browser. screenHeight | Conditional | [\s\S]{1,6} | Total height of the Cardholder’s screen in pixels. Value is returned from the screen.height property. Mandatory for 3DS v2. |

customer.browser. screenWidth | Conditional | [\s\S]{1,6} | Total width of the Cardholder’s screen in pixels. Value is returned from the screen.width property. Mandatory for 3DS v2. |

customer.browser. timezone | Conditional | [\s\S]{1,5} | Time-zone offset in minutes between UTC and the Cardholder browser local time. Note that the offset is positive if the local time zone is behind UTC and negative if it is ahead Mandatory for 3DS v2. |

customer.browser. userAgent | Conditional | [\s\S]{1,2048} | Exact content of the HTTP user-agent header. Mandatory for 3DS v2. |

customer.browser. javaEnabled | Conditional | true/false | Boolean that represents the ability of the cardholder browser to execute Java. Value is returned from the navigator.javaEnabled property. Mandatory for 3DS v2. |

customer.browser. screenColorDepth | Optional | N2[0-9]{1,2} | Value representing the bit depth of the colour palette for displaying images, in bits per pixel. Obtained from Cardholder browser using the screen.colorDepth property. |

customer.browser. challengeWindow | Optional | N2 | Dimensions of the challenge window that has been displayed to the Cardholder. The ACS shall reply with content that is formatted to appropriately render in this window to provide the best possible user experience. Preconfigured sizes are width x height in pixels of the window displayed in the Cardholder browser window. |

customer.browser. deviceId | Optional | AN32[\s\S]{1,32} | Value representing the customer browser device id. |

customer.status | Optional | A9[\s\S]{1,255} | A status of the customer. Currently two options- NEW, EXISTING. |

Shipping Customer

The shipping customer has the same fields than the billing customer, just as part of the shipping entity. That way you can ship to an entirely different customer.

Parameters

| Required | Format | Description | |

|---|---|---|---|

shipping.customer.* | Optional | All the fields that are available under customer except shipping.customer.browserFingerprint.* and shipping.customer.browser.deviceId Same as for customer fields |

Billing Address

The billing address holds the address of the customer. Information sent in the billing address data structure can optionally be used for risk checks such as AVS for card processing.

It is recommended to send ASCII characters for address information.

EastPay accepts and stores non-ASCII characters correctly and displays them correctly in reports, but non-ASCII may affect address verification results.

Parameters

| Required | Format | Description | |

|---|---|---|---|

billing.street1 | Conditional | AN100[\s\S]{1,100} | The door number, floor, building number, building name, and/or street name of the billing address Mandatory for 3D Secure v2. |

billing.street2 | Conditional | AN100[\s\S]{1,100} | The adjoining road or locality (if required) of the billing address The combination of billing.street1 and billing.street2 can't contain numbers only, it should also include characters. |

billing. houseNumber1 | Optional | AN100[\s\S]{1,100} | Primary house number (door number or building number) of the billing address. If present, then billing.street1 is assumed to contain only the name of the street. Also, billing.street2 will be ignored. |

billing. houseNumber2 | Optional | AN100[\s\S]{1,100} | Secondary house number (floor, building name) of the billing address. Used when more addresses are bundled to a same primary house number. If present, billing.houseNumber1 is also mandatory. |

billing.city | Conditional | AN48[\s\S]{1,48} | The town, district or city of the billing address Mandatory for 3D Secure v2. |

billing.state | Conditional | AN10[a-zA-Z0-9.]{1,10} | The county, state or region of the billing address |

billing.postcode | Conditional | AN10[A-Za-z0-9]{1,10} | The postal code or zip code of the billing address Mandatory for 3D Secure v2. |

billing.country | Conditional | A2[A-Z]{2} | The country of the billing address (ISO 3166-1) Mandatory for 3D Secure v2. |

billing.normalized | Optional | AN255[\s\S]{1,255} | The normalized shipping address. |

billing. validationStatus | Optional | AN255[\s\S]{1,255} | Indicates whether a address got validated and normalized address got confirmed by the consumer |

Shipping Address

The shipping address holds the location and recipient of ordered goods. This can be used for risk processing or logistics.

Parameters

| Required | Format | Description | |

|---|---|---|---|

shipping.street1 | Conditional | AN100[\s\S]{1,100} | The door number, floor, building number, building name, and/or street name of the shipping address |

shipping.street2 | Conditional | AN100[\s\S]{1,100} | The adjoining road or locality (if required) of the shipping address |

shipping. houseNumber1 | Optional | AN100[\s\S]{1,100} | Primary house number (door number or building number) of the shipping address. If present, then shipping.street1 is assumed to contain only the name of the street. Also, shipping.street2 will be ignored. |

shipping. houseNumber2 | Optional | AN100[\s\S]{1,100} | Secondary house number of the shipping address (floor, building name). Used when more addresses are bundled to a same primary house number. If present, shipping.houseNumber1 is also mandatory. |

shipping.city | Conditional | AN50[a-zA-Z]{1,50} | The town, district or city of the shipping address |

shipping.state | Conditional | AN10[a-zA-Z0-9.]{1,10} | The county, state or region of the shipping address |

shipping.postcode | Conditional | AN10[A-Za-z0-9]{1,10} | The postal code or zip code of the shipping address |

shipping.country | Conditional | A2[A-Z]{2} | The country of the shipping address (ISO 3166-1) |

shipping. destinationType | Optional | AN20[A-Za-z0-9]{1,20} | Shipping destination of item. Example: Commercial, Residential, Store |

shipping. destinationCode | Indicates destination chosen for the transaction. Possible values: 01- Ship to cardholder billing address 02- Ship to another verified address on file with merchant 03- Ship to address that is different than billing address 04- Ship to store (store address should be populated on request) 05- Digital goods 06- Travel and event tickets, not shipped 07- Other AN2 Optional | ||

shipping.method | Conditional | AN30[a-z_]{4,30} | Shipping method of the product: lowcost: Lowest-cost service sameday: Courier or same |

shipping.cost | Conditional | N13[0-9]{1,10}.[0-9]{2} | Total hipping cost |

shipping.comment | Conditional | AN160[\s\S]{1,160} | A comment for the shipping |

shipping. expectedDate | Optional | AN10{19|20)([0-9]{2})-(0[1-9]|1[0-2])-(0[1-9]|1[0-9]|2[0-9]|3[0-1]} | The expected delivery date |

shipping. logisticsProvider | Optional | AN255[\s\S]{1,255} | The logistics provider of the shipping |

shipping. trackingNumber | Optional | AN255[\s\S]{1,255} | The tracking number of the shipping |

shipping. returnTrackingNumber | Optional | AN255[\s\S]{1,255} | The tracking number issued for returns |

shipping. normalized | Optional | AN255[\s\S]{1,255} | The normalized shipping address. |

shipping. validationStatus | Optional | AN255[\s\S]{1,255} | Indicates whether a address got validated and normalized address got confirmed by the consumer |

shipping. warehouse | Optional | AN100[\s\S]{1,100} | The warehouse that fulfilled the order |

shipping. preference | Optional | AN21 GET_FROM_FILE NO_SHIPPING SET_PROVIDED_ADDRESS | Indicates the shipping preference. Possible values: GET_FROM_FILE | use the shipping address provided by customer at acquirer hosted pages. NO_SHIPPING | no shipping is expected for the purchase. Preferred option for digital goods. SET_PROVIDED_ADDRESS use the merchant provided address. The customer can't change this address on the acquirer hosted pages. Default value: GET_FROM_FILE |

Merchant

The merchant data structure can be used to override the information that is shown on the cardholder statement. It can also be used for payment facilitators.

Parameters

| Required | Format | Description | |

|---|---|---|---|

merchant.name | Mandatory | AN100[\s\S]{1,100} | The registration name of the merchant. |

merchant.business | Mandatory | AN22[\s\S]{1,22} | The name of the merchant. It will normally make up the first line of the card holder statement. |

merchant.website | Optional | AN100[\s\S]{1,100} | This normally makes up the second line of the card holder statement. |

merchant.street | Mandatory | AN100[\s\S]{1,100} | The door number, floor, building number, building name, and/or street name of the merchant |

merchant.postcode | Mandatory | AN10[A-Za-z0-9-]{1,10} | The postal code or zip code of the merchant |

merchant.city | Mandatory | AN50[a-zA-Z0-9]{1,50} | The city of the merchant |

merchant.state | Mandatory | AN50[a-zA-Z0-9]{1,50} | The county, state or region of the merchant |

merchant.country | Mandatory | A2[A-Za-z]{2} | The country of the merchant |

merchant.phone | Optional | AN25[a-zA-Z0-9+-.]{0, 25} | The merchant's phone number. |

merchant.mmcc | Mandatory | AN4[0-9]{0, 4} | The merchant's category code (Mastercard). |

merchant.vmcc | Mandatory | AN4[0-9]{0, 4} | The merchant's category code (Visa). |

merchant.pfId | Optional | AN11[\s\S]{1,11} | The Payment Facilitators if of the merchant |

merchant.isoId | Optional | AN8[\s\S]{1,11} | The Independent Sales Organization of the merchant |

merchant.submerchantId | Optional | AN15[\s\S]{1,100} | The id of the sub-merchant of the payment facilitator. |

Card on File

Following are all the parameters needed for sending card on file transactions.

Parameters

| Required | Format | Description | |

|---|---|---|---|

standingInstruction. type | Optional | UNSCHEDULED , INSTALLMENT,RECURRING | The category of the transaction. RECURRING: Recurring Transactions are transactions that are processed on a regular fixed interval for a pre-agreed or advised amount, where applicable. Recurring Transactions don't have a fixed duration and will continue to be processed until the cardholder cancels the agreement. INSTALLMENT: Installment Payments are transactions that are processed on a regular fixed interval for a pre-agreed amount for a single purchase of good or services. Unlike Recurring Transactions, Installment Payments do have a fixed duration and shouldn't continue to be processed after the end of the agreed installment period. UNSCHEDULED: An unscheduled credential-on-file transaction is like a recurring transaction but differs in that it does not happen at pre-agreed intervals. The classic example of such a transaction is when it is triggered by an event such as an amount threshold to ensure that a pay-as-you-go account always has a minimum available reserve. |

standingInstruction. mode | Optional | INITIAL ,REPEATED | Indicating the mode of subsequent payment transaction. INITIAL: The payment is the first of a series of payments. This first payment must contain additional data like the CVV code or 3D parameters to enable an initial authentication of the request. REPEATED: The payment is a subsequent payment. It may not contain shopper authentication data like the CVV code or 3D parameters - the shopper is not present anymore. |

standingInstruction. source | Conditional | AN | Indicating the type of subsequent payment transaction. CIT: Cardholder initiated transaction. MIT: Merchant initiated transaction. |

standingInstruction. initialTransactionId | Optional | (No specific format-Depends on acquirer) | The value/ID is received as part of the acquirer response of a CIT flagged transaction. The ID is received in OPP response field: standingInstruction.initialTransactionId. The ID must be included in all following MIT flagged transaction. AN or N |

standingInstruction. industryPractice | Optional | INCREMENTAL_AUTH, RESUBMISSION, REAUTHORIZATION, DELAYED_CHARGES ,NO_SHOW | The MIT types defined under this category are performed to fulfill a business practice as a follow-up to an original cardholder-merchant interaction that could not be completed with one single transaction. INCREMENTAL_AUTH: Incremental authorizations can be used to increase the total amount authorized. Incremental authorizations do not replace the original authorization — they are additional to previously authorized amounts — the sum of all linked estimated and incremental authorizations represent the total amount on hold in the cardholder’s account for a given transaction. RESUBMISSION: When a merchant attempts to authorize a transaction after the service has been used but the issuer declines it for insufficient funds, they may attempt to re-authorize to recover the debt. These authorization requests are considered resubmission authorizations and must carry the new "re submission" indicator. REAUTHORIZATION: Re-authorization occurs when a merchant has a need to submit an authorization request after the cardholder has left the point of interaction and there is no possibility of re-authenticating the card or the cardholder. A merchant may need to do this if they intend to split the shipment into multiple deliveries and will only authorize as goods come into stock. If the need to re-authorize occurs, the subsequent authorization requests carry the new "re-authorization" marker and the scheme reference data from the initial interaction. DELAYED_CHARGES and NO_SHOW: Such transactions occur largely in the rental and hospitality sectors. These transactions also carry the scheme reference data provided in the initial authorization at the start of the rental or stay agreement as well as in the settlement record. |

standingInstruction. expiry | Conditional / Mandatory when processing 3D Secure on recurring /installment. | yyyy-MM-dd | Recurring Expiry: Date after which no further authorizations shall be performed. Recurring transaction. Installment transaction. |

standingInstruction. frequency | Conditional / Mandatory when processing 3D Secure on recurring /installment. | N4 | Recurring Frequency: Indicates the minimum number of days between authorisations. Recurring transaction. Installment transaction. Integer value indicating the minimum number of days between recurring authorizations. A frequencyof monthly is indicated by the value 28. Multiple of 28 days will be used to indicate months. Example: 6 months = 168, Example values accepted (31 days): 31, 031, 0031. Note This field is required for recurring transactions |

standingInstruction. numberOfInstallments | Conditinoal | N3 | Installment Payment Data: Indicates the maximum number of authorisations permitted for installment payments. |

Order Information

Contains detailed order-level information.

Parameters

| Required | Format | Description | |

|---|---|---|---|

order.totalAmount | Conditional | N10.N2[0-9]{1,10}(.[0-9]{2})? | Grand total for the order. You can include a decimal point (.), but no other special characters. |

order.currency | Conditional | AN3[\s\S]{1,3} | Currency used for the order |

order.preOrder | Optional | AN30[\s\S]{1,30} | Indicates whether cardholder is placing an order with a future availability or release date. This field can contain one of these values:MERCHANDISE_AVAILABLE: Merchandise available FUTURE_AVAILABILITY: Future availability |

order.preOrderDate | Optional | AN8[\s\S]{1,8} | Expected date that a pre-ordered purchase will be available. Format: YYYYMMDD |

order.reordered | Optional | true/false | Indicates whether the cardholder is reordering previously purchased merchandise. This field can contain one of these values: false: First time ordered true: Reordered |

order.giftWrap | Optional | true/false | Boolean that indicates whether the customer requested gift wrapping for this purchase. This field can contain one of the following values: true: The customer requested gift wrapping. false: The customer did not request gift wrapping. |

order.returnAccepted | Optional | true/false | Boolean that indicates whether returns are accepted for this order. This field can contain one of the following values: true: Returns are accepted for this order.- false: Returns are not accepted for this order. |

order.totalOffersCount | Optional | AN3[\s\S]{1,8} | Total number of articles/items in the order as a numeric decimal count. Possible values: 00 - 99 |

Airline

The airline data structure holds passenger and trip leg airline information.

The airline passenger and leg items are counted up by changing the index-number [n], starting with 0.

Parameters

| Required | Format | Description | |

|---|---|---|---|

airline. actualFinalDesitination | Optional | AN10[\s\S]{1,10} | IATA Code for the actual final destination that the customer intends to travel to. It should be a destination on the completeRoute. |

airline. completeRoute | Optional | AN255[\s\S]{1,255} | Concatenation of individual travel legs in the format ORIG1-DEST1[:ORIG2-DEST2...:ORIGn-DESTn], for example, SFO-JFK:JFK-LHR:LHR-CDG. For airport codes, see the IATA Airline and Airport Code Search. Note In your request, send either the complete route or the individual legs (_leg#_orig and _leg#_dest). If you send all the fields, the value of _complete_route takes precedence over that of the _leg# fields. |

airline.depatureTime | Optional | [\s\S]{1,30} | Departure date and time of the first leg of the trip. Use one of the following formats: yyyy-MM-dd HH:mm z, yyyy-MM-dd hh:mm a z, yyyy-MM-dd hh:mma z, HH = hour in 24-hour format, hh = hour in 12-hour format, a = am or pm (case insensitive), z = time zone of the departing flight, for example: If the airline is based in city A, but the flight departs from city B, z is the time zone of city B at the time of departure. Important For travel information, use GMT instead of UTC, or use the local time zone. Examples: 2011-03-20 11:30 PM PDT, 2011-03-20 11:30pm GMT, 2011-03-20 11:30pm GMT-05:00 AN30 |

airline.journeyType | Optional | AN30[\s\S]{1,30} | Type of travel, for example one way or round trip. |

airline.totalTaxAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The total amount of tax |

airline.totalFeesAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The total fees |

airline.totalFareAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The total fare |

airline.ticketIssueDate | Conditional | AN10{19|20)([0-9]{2})-(0[1-9]|1[0-2])-(0[1-9]|1[0-9]|2[0-9]|3[0-1]} | The date the booking/ticket was made |

airline. ticketIssueAddress | Conditional | AN255[\s\S]{1,255} | The address that issued the ticket |

airline. thirdPartyBooking | Conditional | AN255[\s\S]{1,255} | Indicates if the ticket was booked via a third party |

airline. bookingType | Conditional | AN255[\s\S]{1,255} | The type of booking |

airline. ticketDeliveryMethod | Conditional | AN255[\s\S]{1,255} | The delivery method of the ticket |

airline. bookingRefNum | Conditional | AN255[\s\S]{1,255} | The booking reference number |

airline.agentName | Conditional | AN255[\s\S]{1,255} | The agent name |

airline.agentCode | Conditional | AN255[\s\S]{1,255} | The agent code |

airline.passengers[n]. type | Conditional | AN3[\s\S]{1,3} | The passenger type ADT: Adult,CNN: Child, INF: Infant, YTH: Youth, STU: Student,SCR: Senior Citizen, MIL: Military |

airline.passengers[n]. givenName | Conditional | AN48[\s\S]{1,48} | The given name of the passenger |

airline.passengers[n]. surname | Conditional | AN48[\s\S]{1,48} | The given name of the passenger |

airline.passengers[n]. nationality | Conditional | AN2 | Passenger's nationality country(Country code). |

airline.passengers[n]. ticketRestricted | Conditional | AN255[\s\S]{1,255} | Indicates if the passenger has a restricted ticket |

airline.passengers[n]. ticketNumber | Conditional | AN255[\s\S]{1,255} | The passenger's ticket number |

airline.passengers[n]. status | Conditional | AN25[\s\S]{1,25} | Your company's passenger classification, such as with a frequent flyer program. Standard, Gold,Platinum |

airline.passengers[n]. phone | Conditional | AN255[\s\S]{1,255} | The passenger's phone |

airline.passengers[n]. frequentFlyerNumber | Conditional | AN255[\s\S]{1,255} | The passenger's frequent flyer number |

airline.passengers[n]. email | Conditional | AN255[\s\S]{1,255} | The passenger's email |

airline.passengers[n]. dob | Conditional | AN255[\s\S]{1,255} | The passenger's date of birth |

airline.passengers[n]. checkDigit | Conditional | AN255[\s\S]{1,255} | The check digit for the passenger |

airline.passengers[n]. legs[n].ticketNumber | Conditional | AN255[\s\S]{1,255} | The ticket number for the leg |

airline.passengers[n]. legs[n].taxAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The tax amount for the leg |

airline.passengers[n]. legs[n].stopOverAllowed | Conditional | AN255[\s\S]{1,255} | Indicates if a stop over is allowed |

airline.passengers[n]. legs[n].restrictions | Conditional | AN255[\s\S]{1,255} | Indicates if there is restrictions for the leg |

airline.passengers[n]. legs[n].flightNumber | Conditional | AN255[\s\S]{1,255} | The flight number for the leg |

airline.passengers[n]. legs[n].feesAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The fees for the leg |

airline.passengers[n]. legs[n].fareBasis | Conditional | AN255[\s\S]{1,255} | The fare basis for the leg |

airline.passengers[n]. legs[n].fareAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The fare amount for the leg |

airline.passengers[n]. legs[n].exchangeTicketNum | Conditional | AN255[\s\S]{1,255} | The exchange ticket number for the leg |

airline.passengers[n]. legs[n].departureTaxAmount | Conditional | N10.N2[0-9]{1,10}.[0-9]{2} | The departure tax amount for the leg |

airline.passengers[n]. legs[n].departureCountry | Conditional | AN255[\s\S]{1,255} | The departure country for the passenger |

airline.passengers[n]. legs[n].departureAirport | Conditional | AN255[\s\S]{1,255} | The departure airport for the passenger |

airline.passengers[n]. legs[n].airlineName | Conditional | AN255[\s\S]{1,255} | The name of the airline for the leg |

airline.passengers[n]. legs[n].airlineCode | Conditional | AN255[\s\S]{1,255} | The code of the airline for the leg |

airline.passengers[n]. legs[n].departureTime | Conditional | AN255[\s\S]{1,255} | The departure time for the leg |

airline.passengers[n]. legs[n].departureDate | Conditional | AN10{19|20)([0-9]{2})-(0[1-9]|1[0-2])-(0[1-9]|1[0-9]|2[0-9]|3[0-1]} | The departure date for the leg |

airline.passengers[n]. legs[n].arrivalCountry | Conditional | AN255[\s\S]{1,255} | The destination country for the leg |

airline.passengers[n]. legs[n].arrivalAirport | Conditional | AN255[\s\S]{1,255} | The destination airport for the leg |

airline.passengers[n]. legs[n].arrivalTime The | Conditional | AN255[\s\S]{1,255} | arrival time for the leg |

airline.passengers[n]. legs[n].arrivalDate | Conditional | AN10{19|20)([0-9]{2})-(0[1-9]|1[0-2])-(0[1-9]|1[0-9]|2[0-9]|3[0-1]} | The arrival date for the leg |

airline.passengers[n]. legs[n].couponNumber | Conditional | AN255[\s\S]{1,255} | The coupon number for the leg |

airline.passengers[n]. legs[n].classOfService | Conditional | AN255[\s\S]{1,255} | The class of service for the leg |

airline.passengers[n]. legs[n].carrierCode | Conditional | AN255[\s\S]{1,255} | The carrier code for the leg |

airline.passengers[n]. legs[n].timeToDeparture | Conditional | AN10[\s\S]{1,10} | The airline time to departure, in days, for the leg |

Cart

The cart data structure holds product information about the shopping cart such as the product's ID, name, quantity and price.

The cart items are counted up by changing the index-number [n], starting with 0, and maximum 1000. Example: cart.items[0].name=First Cart Item

Parameters

| Required | Format | Description | |

|---|---|---|---|

cart.items[n]. name | Conditional | AN255[\s\S]{1,255} | The name of the item in the shopping cart. Example:cart.items[0].name=First Cart Item |

cart.items[n]. merchantItemId | Conditional | AN255[\s\S]{1,255} | The unique identifier of the item in the shopping cart. |